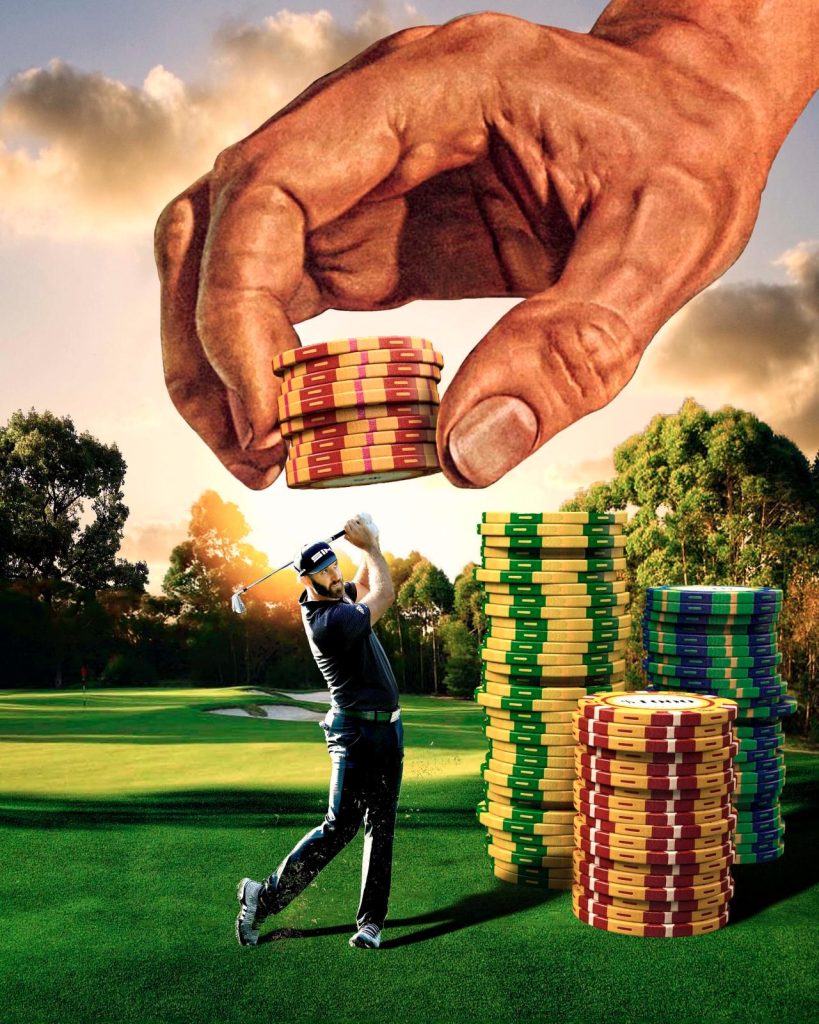

U.S. Betting Market

U.S. Betting Market Will Be Worth $56 Billion by 2023

In 2018, the United States Supreme Court lifted the sports betting ban. This means that each state can now begin legalizing sports betting. Seventeen U.S. states have legalized sports betting, and more will likely follow soon.

New York has recently legalized online sports betting, and Ohio has legalized it as well. California is debating whether or not to allow sports betting, and a favorable outcome is widely anticipated.

According to Goldman Sachs, the online gambling market in the United States could be worth $56 billion by 2023, which is an enormous amount of money. Every bookie wants a piece of the action and profits, including some highly ambitious Australian betting sites.

Bookies’ Share Prices Skyrocketed

Three of the largest casinos in the United States, Caesars, Baily’s, and Wynn Resorts, have launched mobile betting apps and online betting sites. DraftKings and FanDuel, among others, miss this opportunity and have integrated their apps and sites for sports betting. International titans such as Flutter Entertainment, which owns Sportsbet, also participated.

Even small Australian bookmakers PointsBet, BetMakers, and BlueBet, began operating in several U.S. states. PointsBet, for instance, is currently accessible in eight U.S. states. The share price of BlueBet in July was $1.14. BlueBet’s share price increased to $2.86 in August after the Australian betting company announced it would invest $50 million in its U.S. expansion.

BetMakers is another Australian company interested in conducting business in the United States. It intends to offer “fixed odds” betting and TOTE betting to American gamblers.

US$7,500 Free Bets for New Customers

It is one thing to launch a gambling app in the United States. But being competitive is something entirely different. Numerous bookmakers who entered the U.S. market quickly realized how challenging it is. For example, even though BlueBet’s share price skyrocketed in August, it is now back down to $1.34.

It In nearly every business niche you enter the USA is a completely different market than the UK or Australia. Traditionally businesses in the UK have dominated the online sports betting niche. These companies to date have failed to dominate the American market.

Market May Have Normalized Now

Sam Swanell, the chief executive officer of PointsBet, claims that the U.S. betting market has become so “hot that the company is struggling to keep up with demand.” He went on to say that share prices fell because betting companies spent so much money on advertising campaigns.

Swanell stated that PointsBet’s target market share in the United States was 10 percent in each state where it operated. Swanell noted that live betting was the best feature of PointBet. The CEO asserts that the company’s in-play wagering options are superior to that of most of its U.S. rivals, which will help the company reach 10 percent.